Introduction to Business Insurance Costs

Business insurance is a vital component for protecting the various risks that companies face. These risks can range from property damage to liability issues, and the costs associated with managing these risks through insurance can be substantial. Understanding the factors that influence business insurance costs is crucial for companies looking to optimize their expenditures while maintaining adequate protection.

Insurance premiums for businesses are determined by several key factors. These include the size and type of the business, its location, the value of its assets, the nature of its operations, and its claim’s history. Insurance providers assess these variables to estimate the likelihood of a business filing a claim and the potential cost of such claims. Higher perceived risks typically result in higher premiums.

Key factors affecting business insurance costs:

- Size and Type of Business: Larger businesses or those involved in high-risk activities may face higher insurance costs.

- Location: Businesses in areas prone to natural disasters or with higher crime rates may have higher premiums.

- Value of Assets: The more valuable a company’s assets, the higher the potential insurance costs to cover those assets.

- Nature of Operations: Companies engaged in more hazardous activities tend to have higher insurance premiums.

- Claims History: Businesses with a history of frequent or high-cost claims may be charged more for insurance.

By understanding these factors, businesses can identify areas where they can potentially reduce their insurance costs. One prominent method for lowering premiums is by investing in security measures, such as alarm systems. Insurers often offer discounts to businesses that take proactive steps to mitigate risks, as these measures can significantly reduce the likelihood of claims.

Alarm systems, in particular, are recognized for their effectiveness in preventing incidents that could lead to insurance claims. These systems can deter crime, detect fires, and monitor various environmental conditions, thereby reducing the risk of significant damage or loss. As a result, insurers are more likely to offer lower premiums to businesses that implement and maintain such systems.

In summary, comprehending the various elements that influence business insurance costs is pivotal for companies aiming to manage their expenses effectively. Leveraging risk mitigation tools like alarm systems can play a crucial role in achieving lower insurance premiums while ensuring robust protection for business assets and operations.

Alarm Systems: An Overview

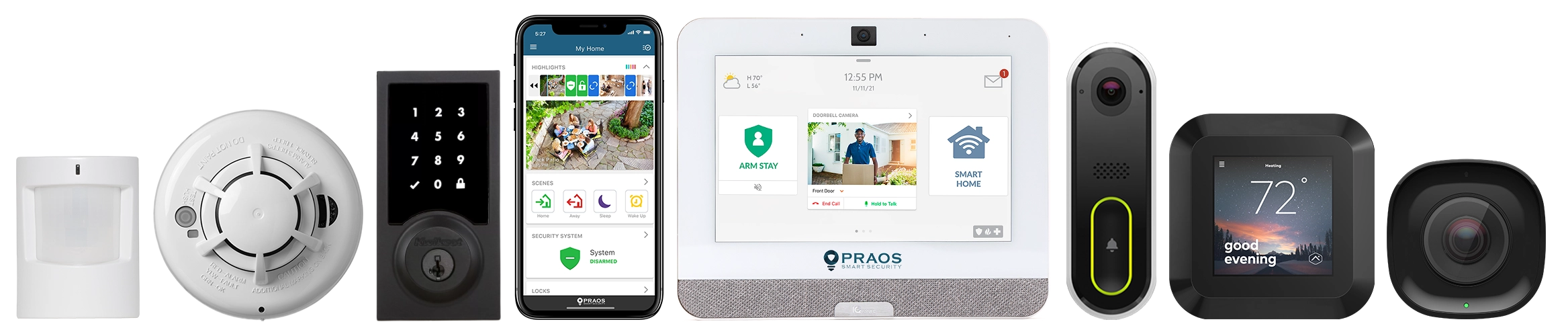

Alarm systems are technological solutions designed to detect and notify about unauthorized access, fire, smoke, gas leaks, and other potential safety hazards in business premises. These systems serve as a critical component in safeguarding company assets, data, and personnel. They can vary significantly in complexity and functionality, from basic entry-level setups to highly sophisticated configurations with multiple layers of detection and notification capabilities.

Modern alarm systems commonly include various sensors and detectors, control panels, communication devices, and notification systems. Sensors typically detect movement, break-ins, fire, smoke, and environmental conditions such as gas leaks or flooding. Control panels act as the central processing unit, interfacing between the sensors and the user or monitoring service. Communication devices ensure timely transmission of alerts to relevant parties, which may include business owners, security personnel, and emergency response services. Notification systems, such as sirens, bells, or lights, provide immediate on-site warnings of an intrusion or danger.

Alarm systems are classified based on their functionality and monitoring options:

- Burglar Alarms: These systems are primarily designed to detect unauthorized entries. They are equipped with door and window sensors, motion detectors, and glass-break sensors.

- Fire Alarms: These systems focus on detecting smoke, heat, or flames, often integrating smoke detectors, heat detectors, and manual call points.

- Environmental Alarms: These systems monitor environmental conditions such as gas leaks, flooding, and extreme temperatures using appropriate sensors.

- Combined Systems: These are integrated solutions that incorporate burglar, fire, and environmental alarms into a single cohesive system.

In terms of monitoring, alarm systems can be either self-monitored or professionally monitored:

- Self-Monitored Systems: These systems alert the business owner or designated contacts directly through notifications on mobile devices or emails. They are usually more affordable but rely heavily on the recipient’s ability to respond promptly to notifications.

- Professionally Monitored Systems: These systems are linked to a professional monitoring service that operates around the clock. On detecting an alert, the monitoring service verifies the threat and contacts emergency services if necessary. This option generally offers higher security assurance but comes with recurring costs.

The integration of smart technology has significantly enhanced the functionality of modern alarm systems. Smart alarm systems allow remote access and control through mobile apps, integrate with other smart devices, and utilize advanced analytics to differentiate between false alarms and actual threats. Artificial intelligence (AI) and machine learning (ML) are promising enhancements that assist in predictive maintenance and real-time threat assessment, thus increasing the efficiency and reliability of alarm systems.

By employing a comprehensive alarm system, businesses not only protect their physical assets but also potentially qualify for reduced insurance premiums. Insurers recognize the reduced risk associated with premises equipped with effective alarm systems, often offering lower rates as an incentive.

The Relationship Between Alarm Systems and Insurance Premiums

Insurance companies determine premiums based on the level of risk associated with insuring a business. The presence of an alarm system can significantly impact these premiums by mitigating various risks, ultimately leading to reduced insurance costs. This relationship is rooted in the ability of alarm systems to deter criminal activities, minimize property damage, and provide rapid response to emergencies.

Deterrence and Crime Prevention: Alarm systems serve as a deterrent to potential intruders. Several studies indicate that businesses with alarm systems are less likely to be targeted by criminals. The reduced likelihood of theft and vandalism directly translates to lower risk for insurance providers, allowing them to offer reduced premiums. For instance, a 2013 study by the University of North Carolina at Charlotte highlighted that 60% of convicted burglars would seek an alternative target if an alarm were present.

Minimization of Property Damage: Modern alarm systems are often integrated with fire and smoke detectors. These systems can detect fires early and alert authorities promptly, reducing the potential for extensive property damage. In turn, the limited damage lowers the risk for insurers, frequently leading to premium discounts. For example, data from the National Fire Protection Association reveals that the average property damage in reported fires is lower in buildings equipped with fire alarm systems.

Quick Emergency Response: The ability of alarm systems to provide immediate notifications to law enforcement or emergency services is crucial. A rapid response can mitigate the extent of damage and loss during incidents such as burglaries or fires. Insurance companies recognize the value of such features in alarm systems and may offer lower premiums as a result. According to the Insurance Information Institute, businesses with monitored alarm systems often enjoy more favorable insurance rates.

Additionally, some insurance providers offer specific discounts or incentives for businesses that install comprehensive alarm systems. These discounts can vary based on the type of alarm system, its features, and its effectiveness in reducing risk. Businesses are encouraged to consult with their insurance providers to understand the specific benefits and premium reductions available.

Overall, the relationship between alarm systems and insurance premiums is clear: effective alarm systems can lead to significant cost savings on insurance by lowering the perceived risk to insurers. This mutually beneficial dynamic underscores the importance of implementing robust alarm systems in business settings.

Statistical Evidence on Alarm Systems Reducing Insurance Costs

Several studies and reports have been conducted to analyze the effect of alarm systems on business insurance costs. The findings generally support the notion that the installation of alarm systems can, indeed, lead to a reduction in insurance premiums.

A report by the Urban Institute revealed that businesses with alarm systems experienced significant reductions in the risk of burglary and theft. The data showed that the presence of these systems led to a decrease in both the frequency and severity of incidents, which are key factors that insurers consider when determining premiums. As a result, businesses with alarm systems were able to secure lower insurance rates compared to those without such systems.

According to the Insurance Information Institute (III), installing an alarm system can reduce a business’s insurance premium by up to 20%. These reductions are often a result of lower claim frequencies and diminished potential losses. Insurance companies recognize that alarm systems deter criminal activities and promptly alert authorities in case of emergencies, which helps mitigate risks.

An analysis conducted by MarketWatch indicates that insurance providers offer incentives for businesses to enhance their security measures. Specifically, firms identified that alarm systems, especially those integrated with additional security features such as surveillance cameras and monitored access controls, tend to have the most substantial impact on insurance costs.

Furthermore, a white paper by the National Fire Protection Association (NFPA) highlights the positive impact of alarm systems in fire safety. The report found that the presence of fire alarm systems can lead to a decrease in fire-related incidents, which subsequently results in lower insurance premiums. The NFPA illustrates that fire alarms enhance early detection, allowing for quicker response times and minimizing fire damage.

In summary, statistical evidence strongly supports the role of alarm systems in reducing business insurance costs. Data from various authoritative sources consistently demonstrate that businesses investing in these security measures benefit from lower risk profiles, which insurers reward with reduced premiums.

Industry-Specific Case Studies

In assessing the impact of alarm systems on reducing business insurance costs, industry-specific case studies provide valuable insights. These studies illustrate how different sectors benefit from the integration of alarm systems, which not only enhance security but also lead to significant cost savings on insurance premiums.

For example, in the retail industry, businesses that incorporate comprehensive alarm systems—including burglar alarms, fire alarms, and CCTV—experience a notable reduction in insurance costs. Data from the National Retail Federation (NRF) indicates that retailers who install advanced alarm systems can see insurance premium reductions of up to 20%. This is attributed to the decreased risk of theft, vandalism, and fire, which are key factors in insurance underwriting.

Similarly, in the hospitality sector, hotels and resorts have benefited from installing alarm systems. According to a report by the American Hotel and Lodging Association (AHLA), properties equipped with modern alarm technologies have seen an average premium decrease of 15%. This reduction is primarily due to the enhanced safety measures that lower the likelihood of guest injuries and property damage, leading to fewer insurance claims.

Manufacturing facilities also show significant savings. Data from the Manufacturers’ Association for Productivity and Innovation (MAPI) reveals that plants with state-of-the-art alarm systems, including smoke detectors, machinery alarms, and surveillance cameras, benefit from insurance premium reductions ranging from 10% to 25%. These systems mitigate the risks associated with machinery malfunctions and fire hazards, which are primary concerns for insurers.

The technology sector also demonstrates considerable advantages. High-tech firms, which often house expensive equipment and sensitive data, find that installing integrated security solutions can lead to an insurance cost reduction of 15% to 30%, as noted by the Technology Services Industry Association (TSIA). The presence of alarm systems reassures insurers about the lowered risk of break-ins and data breaches, resulting in better insurance terms.

Lastly, in the healthcare industry, the implementation of sophisticated alarm systems in clinics and hospitals reduces insurance expenses. A study conducted by the Healthcare Financial Management Association (HFMA) shows that healthcare facilities with comprehensive alarm systems—including patient safety alarms, fire alarms, and intrusion detection systems—enjoy an average insurance premium reduction of 12%. These systems help prevent incidents that could lead to costly claims, like theft of medical equipment and patient harm.

In conclusion, the implementation of alarm systems across various industries not only enhances security but also yields significant insurance cost savings. These real-world examples underscore the effectiveness of alarm systems in mitigating risks, thereby justifying the investment and encouraging wider adoption in different sectors.

Best Practices for Implementing Alarm Systems to Lower Insurance Costs

Implementing alarm systems effectively is crucial for businesses seeking to lower their insurance costs. Here are several best practices that can help ensure these systems are both efficient and compliant with insurance requirements.

Firstly, businesses should choose alarm systems that are certified by recognized security standards organizations such as Underwriters Laboratories (UL) or the National Fire Protection Association (NFPA). Certification ensures that the alarm system meets stringent quality and reliability criteria, which can be a significant factor in persuading insurers to offer premium reductions.

Secondly, integrating different types of alarm systems can enhance overall security and further reduce insurance premiums. A combination of intrusion detection, fire alarms, and CCTV surveillance can provide comprehensive protection. This multipronged approach not only improves security but also signals to insurers a high level of risk management.

The proper maintenance and regular testing of alarm systems are also vital. Insurance companies often require proof of maintenance to ensure that the systems are functional and effective. Regular maintenance helps prevent false alarms and ensures that the systems are operational when needed.

Training employees on the proper use of alarm systems is another best practice. Ensuring that staff know how to arm and disarm systems correctly can prevent accidental activations and demonstrate to insurers that the business takes its security protocols seriously.

Another critical practice is maintaining clear communication with your insurance provider. Informing insurers about the specifics of the alarm systems in place, including any recent upgrades or changes, can help them understand the level of security and adjust premiums accordingly.

Finally, keeping detailed records of all alarm system specifications, maintenance activities, and training logs can be beneficial. This documentation can be presented to insurance companies to verify the implementation and upkeep of security measures.

Here is an overview of key practices and considerations:

| Practice | Consideration |

|---|---|

| Choose Certified Systems | Look for UL or NFPA certifications |

| Integrate Multiple Systems | Combine intrusion, fire, and CCTV alarms |

| Maintain Regularly | Schedule and document consistent maintenance |

| Employee Training | Proper use to avoid false alarms and ensure effectiveness |

| Communicate with Insurers | Provide detailed information about the alarm systems |

| Keep Records | Document specifications, maintenance, and training |

By following these best practices, businesses can optimize their alarm systems to achieve better security and potentially lower their insurance costs.

Future Trends and Innovations in Alarm Systems for Businesses

As technology continues to advance, the future of alarm systems for businesses is poised for significant innovation and development. Emerging trends in this field are expected to further enhance security measures, contributing to even greater reductions in business insurance costs.

One of the key trends is the integration of Artificial Intelligence (AI) into alarm systems. AI-powered systems can analyze patterns and detect anomalies in real-time, providing a higher level of security. These systems can learn from past incidents to predict and prevent potential threats, thereby improving overall effectiveness. According to a report by MarketsandMarkets, the AI in the security market is projected to grow from USD 6.9 billion in 2020 to USD 34.8 billion by 2025, indicating a significant investment and interest in this technology.

Another important development is the use of Internet of Things (IoT) devices in alarm systems. IoT enables various security devices to communicate with each other, creating a more cohesive and responsive security network. For instance, sensors can be placed in strategic locations to monitor activity and trigger alarms if unusual behavior is detected. A report by Business Insider Intelligence suggests that there will be more than 64 billion IoT devices by 2026, many of which will be used in security applications.

Additionally, alarm systems are increasingly integrating with cloud technology. Cloud-based systems offer several advantages, such as remote monitoring, data storage, and real-time alerts. This enables business owners to monitor their premises from anywhere, ensuring continuous protection. According to a study by MarketsandMarkets, the cloud-based security solutions market size is expected to grow from USD 4.4 billion in 2020 to USD 12.0 billion by 2025, reflecting the increasing adoption of this technology.

Advances in biometric technology are also playing a critical role in modern alarm systems. Biometric systems use unique physical characteristics, such as fingerprints, facial recognition, or retinal scans, to authenticate individuals. This provides a higher level of security compared to traditional methods like passwords or keys. The global biometric system market is projected to grow from USD 36.6 billion in 2020 to USD 68.6 billion by 2025, according to MarketsandMarkets, highlighting the growing reliance on this technology.

In summary, the future of alarm systems for businesses is marked by significant technological advancements. The integration of AI, IoT, cloud technology, and biometrics is expected to enhance security measures, likely leading to further reductions in business insurance costs. As these technologies continue to evolve, businesses can anticipate more sophisticated and effective alarm systems in the coming years.